Global Aerial Imagery Market

Global Aerial Imagery Market, By Platform Type (Fixed-Wing Aircraft, Helicopters, UAVs/Drones, Other Platform Types), By Application (Geospatial Mapping, Infrastructure Planning, Asset Inventory Management, Environmental Monitoring, National and Urban Mapping, Surveillance and Monitoring, Disaster Management, Other Applications), By End-User (Construction, Agriculture, Media & Entertainment, Oil and Gas, Aerospace & Defense, Energy & Power, Government, Other End-user Industries), By Region (North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle-East & Africa (MEA) Trend Analysis, Competitive Market Share & Forecast, 2017-2027

- Published Date: November 2021

- Report ID: BWC1803

- Available Format: PDF

- Page: 197

Report Overview

Global Aerial Imagery Market- Industry Trends & Forecast Report 2027

The global aerial imagery market was worth USD 2.1 billion in 2020 and is further projected to reach USD 5.4 billion by the year 2027, growing at a CAGR of 14.5% in the forecast period. Governments and state agencies use satellite imagery to map essential public service projects. This causes the market to grow fast. Moreover, technological advancements along with the rapidly growing adoption of aerial imagery in many government and non-government industries are projected to drive the market during the forecast period.

Source: BlueWeave Consulting

Global Aerial Imagery Market- Overview

Aerial imagery involves taking pictures of an aerial view through flying objects, such as aircraft, balloons, blimps, parachutes, etc. Normally, aircraft are used for generating highly accurate images. Typically, this is used to map a geographical or physical location topologically or object from a bird's eye view. The aerial imagery is used to collect vital information intended for various purposes, including agricultural management, land use, urban planning, forestry, etc.

Global Aerial Imagery Market Forecast and Trends

Growth Drivers

Growing Aerial Imagery Application in The Construction Industry

The construction industry is emerging as one of the leading sectors for the adoption of aerial imagery. Contractors are increasingly deploying drones to collect real-time data pertaining to a site and design a building or project accordingly. Additionally, aerial imagery can keep track of progress and detect problems or issues in advance. Engineers are also using aerial imagery for estimating and minimizing overall costs. With increasing construction activities, especially in developing countries, the demand for aerial imagery is anticipated to rise, propelling the overall market growth.

Research and Development Activities in Aerial Imagery

Both public and private entities are researching aerial imagery due to its significant growth potential. R&D activities are focused on advancing aerial imagery technology and expanding its applications in various industries. For instance, recent research published in Nature Communications indicated that aerial imagery could be used to protect food crops from pathogen attacks like Xylella fastidiosa (Xf). The aerial imagery can achieve 92% accuracy in detecting Xf and can also assist in eradicating it.

Restraints

Restrictions on Non-Government Applications of Drones

Several regions and countries have imposed strict bans on the commercial use of drones for security reasons. Saudi Arabia, Iran, Egypt, Iran, and several states in the United States, including California, Kentucky, Michigan, West Virginia, etc., forbid its use over private properties and public facilities such as railroads, utilities, defense, etc., which limit their use in various applications. As a result, such restrictions act as a major restraint on the growth of the global aerial imagery market.

Impact of COVID-19 on the Global Aerial Imagery Market

The sudden outbreak of the COVD-19 pandemic has had a mixed influence on the global aerial imagery market. On one hand, the operations of various end-user industries, such as oil & gas, construction, aerospace, etc., were halted by the lockdown imposed by the countries and shortage of workforce. However, the market gained significant traction in the government sector as they began using aerial imagery for urban mapping purposes to establish temporary medical facilities and testing centers, which spurred the overall market growth.

Global Aerial Imagery Market - By Platform-Type

Based on platform types, the global aerial imagery market is segmented into fixed-wing aircraft, helicopters, UAVs/drones, and other platform types. Among these, the UAVS/drones account for the largest market share. The adoption of UAVs/drones is gaining significant traction due to its adoption across various sectors, including agriculture and defense intelligence. The drone is a crewless aircraft equipped with state-of-the-art technology such as infrared and digital cameras that can be operated via remote control.

Global Aerial Imagery Market - By Application

Based on applications, the global aerial imagery market is segmented into geospatial mapping, surveillance & monitoring, asset inventory management, infrastructure planning, environmental monitoring, disaster management, national & urban mapping, and other applications. The national & urban mapping segment holds the largest market share because of its prominent use among local and state governments. Urban mapping is used for infrastructure planning, such as designing the layout, prescribing densities of residential, commercial, and industrial areas to exploit maximum efficiency of the land.

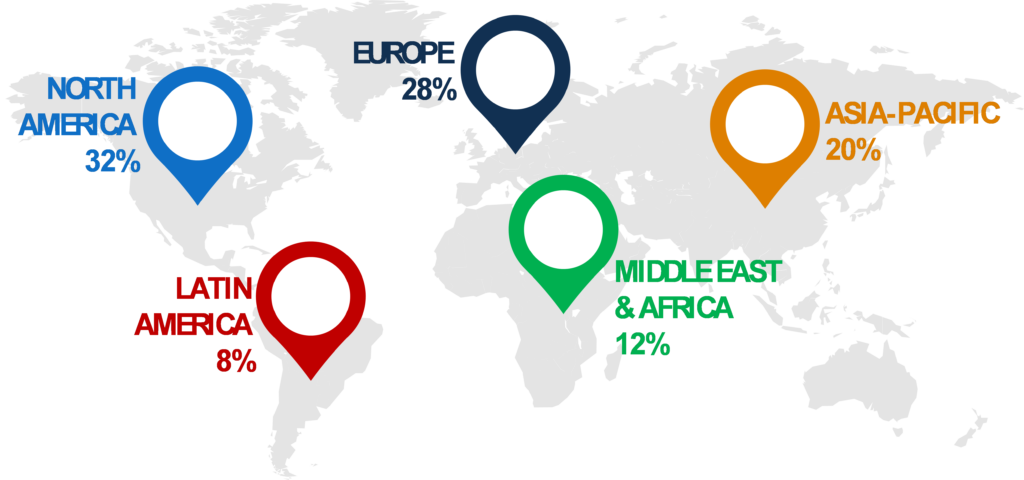

Global Aerial Imagery Market - Regional Insights

Geographically, the global aerial imagery market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle-East & Africa. North America dominates the global aerial imagery market owing to the increase in usage of aerial imagery for mapping sky-rise buildings, dams, and oils & gas plants in the region. A growing urban population and increasing investment in smart cities in the region is boosting the markets for aerial imagery. Moreover, increasing expenditure on defense is anticipated to drive the region’s growth during the forecast period.

Source: BlueWeave Consulting

Competitive Landscape

The leading players in the global aerial imagery market are Eagle View Technologies, Fugro N.V., Digital Aerial Solutions, LLC, Google, Inc, Kucera International, Inc, Blom ASA., Getmapping, PLC, Nearmap Ltd, High Eye Aerial Imagery, NRC Group ASA, SkyIMD, Inc., Airobotics, Global UAV Technologies Ltd., GeoVantage, Inc., Landiscor Real Estate Mapping, Cooper Aerial Surveys Co., Parrot SA, Yuneec International, PrecisionHawk, and other prominent players.

Players in the industry are specializing in improvements in technology and integrated and co-created innovation practices to build an entirely new ecosystem for aerial imagery. This would further strengthen their position and market presence globally. Moreover, competitive strategies, such as partnerships, mergers, acquisitions, collaborations, etc., is also prominent in this market.

Recent Development

- In November 2021, AerialSphere, a US-based mapping service company, announced to have made a nationwide dataset of 360-degree imagery available through the ArcGIS Marketplace.

- In October 2021, Nearmap, an Australian aerial imagery technology, and location data company, announced its partnership with the US state of New Jersey to help streamline decision-making in isolated areas by taking aerial images of the entire Garden State.

Scope of the Report

| Attributes | Details |

| Years Considered | Historical data – 2017-2020 |

| Base Year – 2020 | |

| Forecast – 2021 – 2027 | |

| Facts Covered | Revenue in USD Billion |

| Market Coverage | U.S, Canada, Germany, UK, France, Italy, Spain, Brazil, Mexico, Japan, South Korea, China, India, UAE, South Africa, Saudi Arabia |

| Product Service/Segmentation | By Platform Type, By Application, By End-User, By Region |

| Key Players | Eagle View Technologies, Fugro N.V., Digital Aerial Solutions, LLC, Google, Inc, Kucera International, Inc, Blom ASA., Getmapping, PLC, Nearmap Ltd, High Eye Aerial Imagery, NRC Group ASA, SkyIMD, Inc., Airobotics, Global UAV Technologies Ltd., GeoVantage, Inc., Landiscor Real Estate Mapping, Cooper Aerial Surveys Co., Parrot SA, Yuneec International, PrecisionHawk, and other prominent players. |

By Platform Type

- Helicopters

- UAVs/Drones

- Other Platform Types

By Application

- Geospatial Mapping

- Infrastructure Planning

- Asset Inventory Management

- Environmental Monitoring

- National and Urban Mapping

- Surveillance and Monitoring

- Disaster Management

- Other Applications

By End-User

- Construction

- Agriculture

- Media & Entertainment

- Oil and Gas

- Aerospace & Defense

- Energy & Power

- Government

- Other End-user Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- Research Framework

- Research Objective

- Product Overview

- Key Market Segments

- Research Methodology

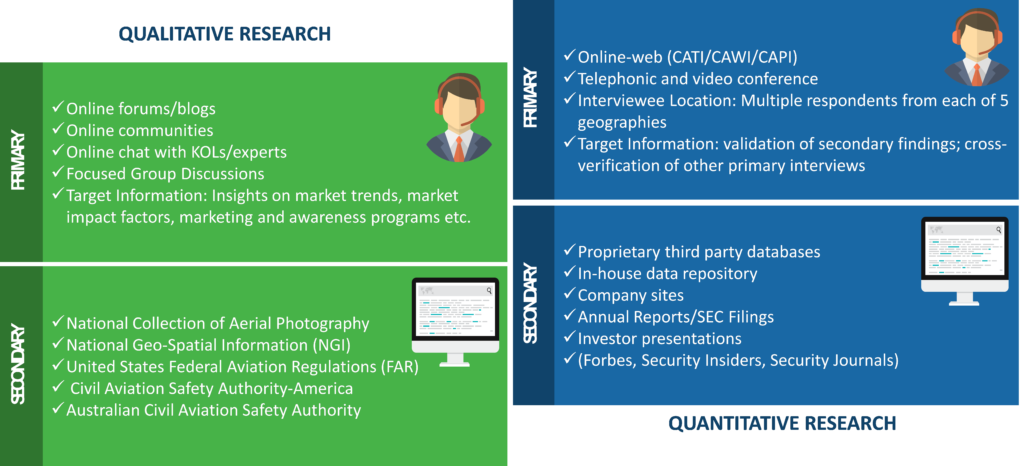

- Qualitative Research

- Methodology

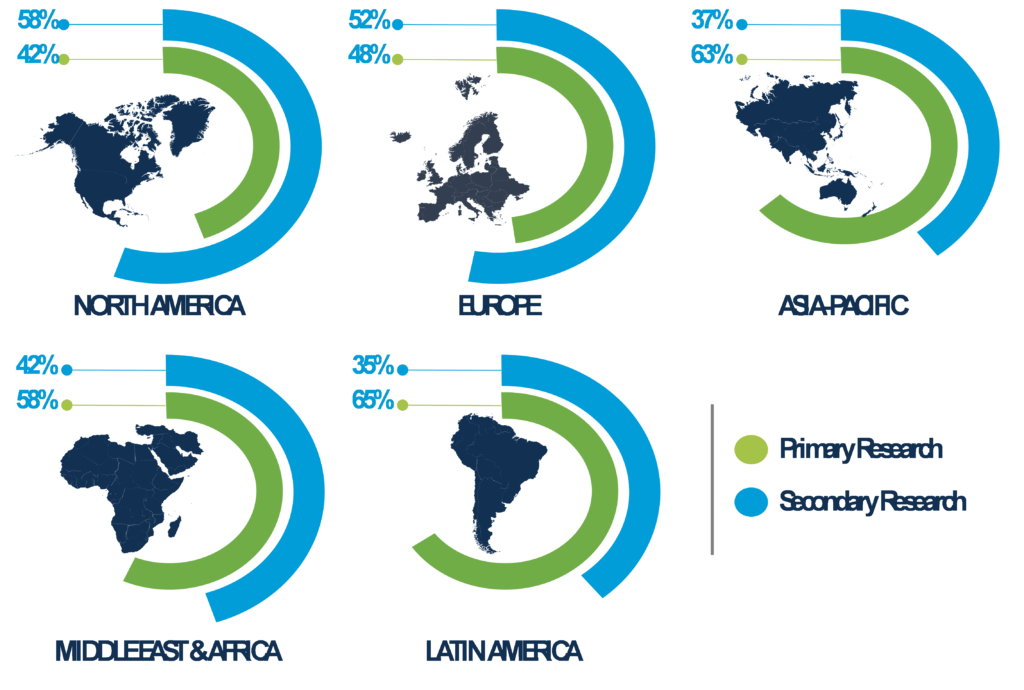

- Regional Split of Primary & Secondary Research

- Secondary Research

- Primary Research

- Breakdown of Primary Research Respondents, By Region

- Breakdown of Primary Research Respondents, By Industry Participants

- Market Size Estimation

- Assumptions for the Study

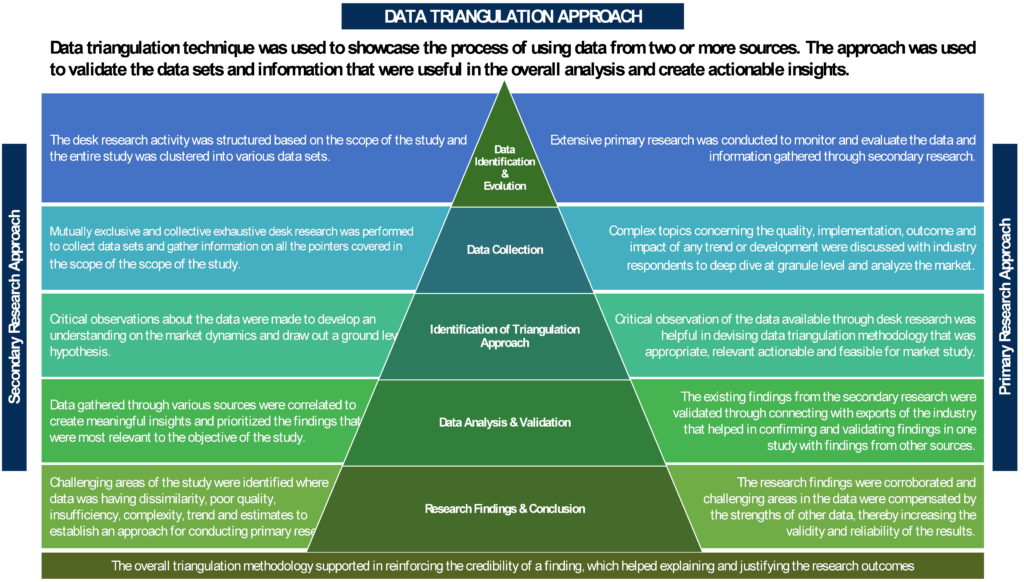

- Market Breakdown & Data Triangulation

- Executive Summary

- Industry Insight and Growth Strategy

- Value Chain Analysis

- DROC Analysis

- Market Drivers

- Expanding Aerial Imagery Application in The Construction Industry

- Research and Development Activities in The Aerial Imagery

- Market Restraints

- Restrictions on Non-Government Applications of Drones

- Market Challenges

- Negative Impact of the COVID-19 Pandemic

- Market Opportunity

- Increasing Use of Drone-Based Technology

- Growing Application of Aerial Imagery for Security Purposes

- Market Drivers

- Recent Developments

- Porter’s Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Intensity of Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Global Aerial Imagery Market Overview

- Market Size & Forecast by Value, 2017-2027

- Market Size and Forecast, By Segment

- By Platform Type

- Fixed-Wing Aircraft

- Helicopters

- UAVs/Drones

- Other Platform Types

- By Application

- Geospatial Mapping

- Infrastructure Planning

- Asset Inventory Management

- Environmental Monitoring

- National and Urban Mapping

- Surveillance and Monitoring

- Disaster Management

- Other Applications

- By End-User

- Construction

- Agriculture

- Media & Entertainment

- Oil and Gas

- Aerospace & Defense

- Energy & Power

- Government

- Other End-user Industries

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- By Platform Type

- North America Aerial Imagery Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Platform Type

- By Application

- By End-User

- By Country

- U.S.

- Canada

- Market Size and Forecast

- Europe Aerial Imagery Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Platform Type

- By Application

- By End-User

- By Country

- Germany

- U.K.

- Russia

- France

- Italy

- Spain

- Rest of Europe

- Market Size and Forecast

- APAC Aerial Imagery Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Platform Type

- By Application

- By End-User

- By Country

- China

- India

- Japan

- South Korea

- Rest of APAC

- Market Size and Forecast

- LATAM Aerial Imagery Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Platform Type

- By Application

- By End-User

- By Country

- Mexico

- Brazil

- Rest of LATAM

- Market Size and Forecast

- MEA Aerial Imagery Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Platform Type

- By Application

- By End-User

- By Country

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- Market Size and Forecast

- Competitive Landscape

- List of Key Players and Their Offerings

- Market Share Analysis (2020)

- Competitive Benchmarking by Operating Parameters

- Impact of COVID-19 on Global Aerial Imagery Market

- Company Profiles (Company Overview, Financial Matrix, Key Product landscape, Key Personnel, Key Competitors, Contact Address, and Strategic Outlook) *

- Eagle View Technologies

- Fugro N.V.

- Digital Aerial Solutions, LLC

- Google, Inc

- Kuncera International, Inc

- Blom ASA.

- Getmapping, PLC

- Nearmap Ltd

- High Eye Aerial Imagery

- NRC Group ASA

- SkyIMD, Inc.

- Airobotics

- Global UAV Technologies Ltd.

- GeoVantage, Inc.

- Landiscor Real Estate Mapping

- Cooper Aerial Surveys Co.

- Parrot SA

- Yuneec International

- PrecisionHawk

- Other Prominent Players

- Key Strategic Recommendations

List of Figures

Figure 1: Global Aerial Imagery Market Segmentation

Figure 2: Global Aerial Imagery Market Value Chain Analysis,

Figure 3: Company Market Share Analysis, 2020

Figure 4: Global Aerial Imagery Market Size, By Value (USD Billion), 2020-2027

Figure 5: Global Aerial Imagery Market Share (%), By Platform Type, By Value, 2020-2027

Figure 6: Global Aerial Imagery Market Share (%), By Application, By Value, 2020-2027

Figure 7: Global Aerial Imagery Market Share (%), By End-User, By Value, 2020-2027

Figure 8: Global Aerial Imagery Market Share (%), By Region, By Value, 2020-2027

Figure 9: North America Aerial Imagery Market Size, By Value (USD Billion), 2020-2027

Figure 10: North America Aerial Imagery Market Share (%), By Platform Type, By Value, 2020-2027

Figure 11: North America Aerial Imagery Market Share (%), By Application, By Value, 2020-2027

Figure 12: North America Aerial Imagery Market Share (%), By End-User, By Value, 2020-2027

Figure 13: North America Aerial Imagery Market Share (%), By Country, By Value, 2020-2027

Figure 14: Europe Aerial Imagery Market Size, By Value (USD Billion), 2020-2027

Figure 15: Europe Aerial Imagery Market Share (%), By Platform Type, By Value, 2020-2027

Figure 16: Europe Aerial Imagery Market Share (%), By Application, By Value, 2020-2027

Figure 17: Europe Aerial Imagery Market Share (%), By End-User, By Value, 2020-2027

Figure 18: Europe Aerial Imagery Market Share (%), By Country, By Value, 2020-2027

Figure 19: the Asia-Pacific Aerial Imagery Market Size, By Value (USD Billion), 2020-2027

Figure 20: the Asia-Pacific Aerial Imagery Market Share (%), By Platform Type, By Value, 2020-2027

Figure 21: the Asia-Pacific Aerial Imagery Market Share (%), By Application, By Value, 2020-2027

Figure 22: the Asia-Pacific Aerial Imagery Market Share (%), By End-User, By Value, 2020-2027

Figure 23: the Asia-Pacific Aerial Imagery Market Share (%), By Country, By Value, 2020-2027

Figure 24: Latin America Aerial Imagery Market Size, By Value (USD Billion), 2020-2027

Figure 25: Latin America Aerial Imagery Market Share (%), By Platform Type, By Value, 2020-2027

Figure 26: Latin America Aerial Imagery Market Share (%), By Application, By Value, 2020-2027

Figure 27: Latin America Aerial Imagery Market Share (%), By End-User, By Value, 2020-2027

Figure 28: Latin America Aerial Imagery Market Share (%), By Country, By Value, 2020-2027

Figure 29: Middle East & Africa Aerial Imagery Market Size, By Value (USD Billion), 2020-2027

Figure 30: Middle East & Africa Aerial Imagery Market Share (%), By Platform Type, By Value, 2020-2027

Figure 31: Middle East & Africa Aerial Imagery Market Share (%), By Application, By Value, 2020-2027

Figure 32: Middle East & Africa Aerial Imagery Market Share (%), By End-User, By Value, 2020-2027

Figure 33: Middle East & Africa Aerial Imagery Market Share (%), By Region, By Value, 2020-2027

List of Tables

Table 1: Global Aerial Imagery Market Size, By Platform Type, By Value, 2020-2027

Table 2: Global Aerial Imagery Market Size, By Application, By Value (USD Billion), 2020-2027

Table 3: Global Aerial Imagery Market Size, By End-User, By Value (USD Billion), 2020-2027

Table 4: Global Aerial Imagery Market Size, By Region, By Value (USD Billion), 2020-2027

Table 5: North America Aerial Imagery Market Size, By Platform Type, By Value (USD Billion), 2020-2027

Table 6: North America Aerial Imagery Market Size, By Application, By Value (USD Billion), 2020-2027

Table 7: North America Aerial Imagery Market Size, By End-User, By Value (USD Billion), 2020-2027

Table 8: North America Aerial Imagery Market Size, By Country, By Value (USD Billion), 2020-2027

Table 9: Europe Aerial Imagery Market Size, By Platform Type, By Value (USD Billion), 2020-2027

Table 10: Europe Aerial Imagery Market Size, By Application, By Value (USD Billion), 2020-2027

Table 11: Europe Aerial Imagery Market Size, By End-User, By Value (USD Billion), 2020-2027

Table 12: Europe Aerial Imagery Market Size, By Country, By Value (USD Billion), 2020-2027

Table 13: the Asia-Pacific Aerial Imagery Market Size, By Platform Type, By Value (USD Billion), 2020-2027

Table 14: the Asia-Pacific Aerial Imagery Market Size, By Application, By Value (USD Billion), 2020-2027

Table 15: the Asia-Pacific Aerial Imagery Market Size, By End-User, By Value (USD Billion), 2020-2027

Table 16: the Asia-Pacific Aerial Imagery Market Size, By Country, By Value (USD Billion), 2020-2027

Table 17: Latin America Aerial Imagery Market Size, By Platform Type, By Value (USD Billion), 2020-2027

Table 18: Latin America Aerial Imagery Market Size, By Application, By Value (USD Billion), 2020-2027

Table 19: Latin America Aerial Imagery Market Size, By End-User, By Value (USD Billion), 2020-2027

Table 20: Latin America Aerial Imagery Market Size, By Country, By Value (USD Billion), 2020-2027

Table 21: The Middle-East & Africa Aerial Imagery Market Size, By Platform Type, By Value (USD Billion), 2020-2027

Table 22: The Middle-East & Africa Aerial Imagery Market Size, By Application, By Value (USD Billion), 2020-2027

Table 23: The Middle-East & Africa Aerial Imagery Market Size, By End-User, By Value (USD Billion), 2020-2027

Table 24: The Middle-East & Africa Aerial Imagery Market Size, By Country, By Value (USD Billion), 2020-2027

Table 25: Eagle View Technologies Financial Analysis

Table 26: Eagle View Technologies Business Overview

Table 27: Fugro N.V. Financial Analysis

Table 28: Fugro N.V. Business Overview

Table 29: Digital Aerial Solutions, LLC Corporation Financial Analysis

Table 30: Digital Aerial Solutions, LLC Corporation Business Overview

Table 31: Google, Inc Financial Analysis

Table 32: Google, Inc Business Overview

Table 33: Kuncera International, Inc Financial Analysis

Table 34: Kuncera International, Inc Business Overview

Table 35: Blom ASA. Financial Analysis

Table 36: Blom ASA. Business Overview

Table 37: Getmapping, PLC Financial Analysis

Table 38: Getmapping, PLC Business Overview

Table 39: Nearmap Ltd Financial Analysis

Table 40: Nearmap Ltd Business Overview

Table 41: High Eye Aerial Imagery Financial Analysis

Table 42: High Eye Aerial Imagery Business Overview

Table 43: NRC Group ASA Financial Analysis

Table 44: NRC Group ASA Business Overview

Table 45: SkyIMD, Inc. Financial Analysis

Table 46: SkyIMD, Inc. Financial Analysis

Table 47: Airobotics Financial Analysis

Table 48: Airobotics Business Overview

Table 49: Global UAV Technologies Ltd. Financial Analysis

Table 50: Global UAV Technologies Ltd. Business Overview

Table 51: GeoVantage, Inc. Financial Analysis

Table 52: GeoVantage, Inc. Business Overview

Table 53: Landiscor Real Estate Mapping Financial Analysis

Table 54: Landiscor Real Estate Mapping Business Overview

Table 55: Cooper Aerial Surveys Co. Financial Analysis

Table 56: Cooper Aerial Surveys Co. Business Overview

Table 57: Parrot SA Financial Analysis

Table 58: Parrot SA Business Overview

Table 59: Yuneec International Financial Analysis

Table 60: Yuneec International Business Overview

Table 61: PrecisionHawk Financial Analysis

Table 62: PrecisionHawk Business Overview

Market Segmentation

By Platform Type

- Fixed-Wing Aircraft

- Helicopters

- UAVs/Drones

- Other Platform Types

By Application

- Geospatial Mapping

- Infrastructure Planning

- Asset Inventory Management

- Environmental Monitoring

- National and Urban Mapping

- Surveillance and Monitoring

- Disaster Management

- Other Applications

By End-User

- Construction

- Agriculture

- Media & Entertainment

- Oil and Gas

- Aerospace & Defense

- Energy & Power

- Government

- Other End-user Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

1. Research Methodology

2. Regional Split of Primary & Secondary Research

3. Secondary Research

The research process began with obtaining historical market sizes of the entire Ariel imagery market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the Ariel imagery market and its expected long-term impact. Weightage was given to several forces that are expected to affect the home security market, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

4. Primary Research

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the global Ariel imagery market were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes.

4.1 Breakdown of Primary Research Respondents, By Region

4.2 Breakdown of Primary Research Respondents, By Industry Participants

5. Market Size Estimation

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by type, by vertical and by application.

An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

6. Assumptions for the Study

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

7. Market Breakdown & Data Triangulation

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

Frequently Asked Questions (FAQs):

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research Support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Custom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.