Wound Closure Product Market

Global Wound Closure Product Market, By Type (Sutures (Absorbable Sutures, Non- Absorbable Sutures), Hemostats (Thrombin Based, Oxidized Regenerated Cellulose Based, Combination Hemostats, Gelatin Based Hemostats, Collagen Based Hemostats), Surgical Staples (Linear Surgical Stapler, Circular Surgical Stapler, Skin Stapler, And Others), Adhesives and Tissue Sealants (Fibrin, Collagen Based, Cyanoacrylate Based, Synthetic Polymer Based, And Albumin & Glutaraldehyde Based), Wound Closure Strips); By Application (Cardiovascular, General, Gynecological, Orthopedic, Ophthalmic, and Others); By Region (North America, Europe, the Asia-Pacific, Rest of the World); Trend Analysis, Competitive Market Share & Forecast, 2017-2027

- Published Date: September 2021

- Report ID: BWC1814

- Available Format: PDF

- Page: 182

Report Overview

The global wound closure product market is projected to register strong growth prospects owing to the increasing number of surgeries in the coming years, and implementation of government policies for reducing raw material costs, and the rising cases of chronic wounds.

Global Wound Closure Product Market- Industry Trends & Forecast Report 2027

The global wound closure product market was worth USD 14,567.0 million in 2020. The market is further expected to reach USD 21.528.1 million by 2027 at a CAGR of 6.0% during the forecast period (2021-2027). As a result of a rising trend in road accidents, chronic wounds, and an aging population, the global wound closure product market has grown substantially over the past few years. Additionally, the growing healthcare policies focused on reducing raw materials costs, along with the rising healthcare expenditure in some developing nations are expected to boost the global wound closure product market.

Source: BlueWeave Consulting

Global Wound Closure Product Market Overview

Generally, wound closure products are used to speed up the healing process by joining the edges of the wound, preventing infections and wound dehiscence. These products are used in the treatment of chronic wounds and surgical wounds. Natural raw materials used in wound closure products are surgical steel, silk, cotton, and linen. Synthetic materials used in wound closure products are nylon, polypropylene, and polybutester.

The term primary wound healing refers to the technique of closing a wound with staples, stitches, glue, and other methods of woundclosure. The primary intention closure technique is applied to cleaner wounds. In secondary intention technique, wounds that are contaminated or have been delayed in clinical consultation are treated. Lastly, the tertiary intention techniqueor delayed primary intention technique involves leaving the surface layers of the wound open for a predetermined period. It is possible to close the surface layers later, just as it is done initially inthe primary intention closure technique, but this time in a "delayed" manner.

Global Wound Closure Product Market Trend

Growth Drivers

An increasing number of road accidents

The National Highway Traffic Safety Administration (NHTSA) report stated that more than 38.675 people lost their lives in a vehicle crash in 2020. It translates to a 7.2% increase in the number of road accidents compared to 2019, which stood at 36,095. In the wake of COVID-19 restrictions, fewer vehicles were on the road, reducing the number of vehicle miles traveled (VMT).It demonstrates that more than 1.37 people per 100 million VMT died in road accidents in 2020, compared to 1.10 people per 100 million VMT in 2019. The increasing number of accidents are indicating a rise in demand for wound closure products, thereby propelling the growth of the global wound closure products market.

Restraints

High Costs of wound closure products

Increasing prices of wound closure products have become a universal problem in healthcare.Dressing strips and products cost around USD 25-35, rendering them unaffordable for many households in the U.S. Additionally, some of the tissue sealants cost around USD 40-80. Due to the high cost of primitive wound closure products, consumers find them unaffordable. It is thus, limiting the growth of the global wound closure market. Moreover, the high cost of chronic wound closure products also limits their adoption in the price-sensitive marketsof developing economies.

Global Wound Closure Product Market - Impact of COVID-19

In March 2020, the WHO declared COVID-19 a pandemic, stating that the countries have no other choice but to implement lockdown restrictions to counter the spread of the virus. Factory operations were put on halt, and key raw materials used for manufacturing wound closure products were also short in supply. However, as the number of COVID-19 cases decreased, it aided in the restructuring of the global wound closure product market.

Rising road accidents and emerging diseases, such as COVID-19, and black fungus, which causes chronic wounds will contribute to the potential of surgeries in the coming years. Therefore, this factor is expected to positively impact the growth of the global wound closure product market.

Global Wound Closure Product Market: By Type

Based on types, the global wound closure product market is segmented into sutures, hemostats, surgical staples, adhesives, and tissue sealants, and wound closure product strips. The sutures segment accounted for the largest share in the global wound closure product market in 2020. A suture holds damaged tissue (resulting from surgery, a cut, a laceration, a road accident, and an injury) together with a thread-like material. They accelerate the healing of wounds and help minimize the risk of infection by tying the edges of the wound, protecting it from infectious bodies.The advantages of sutures are driving the growth of the segment in the global wound closure product market.

Source: BlueWeave Consulting

Global Wound Closure Product Market: By Application

Based on the applications, the global wound closure product market is categorized into cardiovascular, general, gynecological, orthopedic, ophthalmic, and others. The cardiovascular segment garnered the highest share in the global wound closure product market in 2020. According to the WHO, an estimated 17.5 million people lose their lives every year to cardiovascular diseases in lower and middle-income countries. The reduced emphasis on a healthy diet and lifestyle is contributing to the death rates caused by cardiovascular diseases every year. The problem is exacerbated by rising rates of obesity, a problem prevalent in most developed nations. These factors are contributing to the growth of the global wound closure product market.

Global Wound Closure Product Market: Regional Insights

Based on regions, the global wound closure product market is divided into North America, Europe, the Asia-Pacific, and the rest of the world. Among these regions, North America held the largest share in the global wound closure product market in 2020. The U.S. Census Bureau estimated that there were 40.3 million U.S. residents aged 65 and older in 2010, which has increased to 54 million in July 2019. The report indicates that the United States is experiencing an increasing burden of geriatric residents, which may increase the demand for wound closure products in the coming years, thus creating growth opportunities for the global wound closure market.

Source: BlueWeave Consulting

Competitive Landscape

Some of the key players in the global wound closureproduct market are3M Company, Medtronic plc, Smith & Nephew plc, CryoLife Inc., Pfizer Inc., Integra LifeSciences Corporation, Johnson & Johnson, B. Braun Melsungen AG, Baxter International Inc., DeRoyal Industries Inc., and other prominent players. These players are consistently earmarking investments for the research and development of better and efficient wound closure products for reducing the healing period for an individual and capture a higher market share in the global wound closure product market.

Recent Developments

- In July 2021, Smith + Nephew plc announced the launch of its FAST FIX FLEX Meniscus Repair System, which is the only device that provides surgeon-guided flexible needles and shafts that can access all areas of the meniscus. The improved access may allow more opportunities to repair the meniscus rather than remove it altogether, resulting in long-term benefits for the patient.

Scope of the Report

|

Attribute |

Details |

|

Years Considered |

Historical data – 2017-2020 Base Year – 2020 Forecast – 2021 – 2027 |

|

Facts Covered |

Revenue in USD Million |

|

Market Coverage |

U.S., Rest of North America, Germany, UK, France, Rest of Europe, Brazil,Japan, China, India, Rest of Asia-Pacific, and Rest of the World |

|

Type/Service Segmentation |

By Type, Application, and Region |

|

Key Players |

3M Company, Medtronic plc, Smith & Nephew plc, CryoLife Inc., Pfizer Inc., Integra LifeSciences Corporation, Johnson & Johnson, B. Braun Melsungen AG, Baxter International Inc., DeRoyal Industries Inc., and other prominent players |

By Type

- Sutures

- Absorbable Sutures

- Non- Absorbable Sutures

- Hemostats

- Thrombin Based

- Oxidized Regenerated Cellulose Based

- Combination Hemostats

- Gelatin Based Hemostats

- Collagen Based Hemostats

- Surgical Staples

- Linear Surgical Stapler

- Circular Surgical Stapler

- Skin Stapler

- Others

- Adhesives and Tissue Sealants

- Fibrin

- Collagen Based

- Cyanoacrylate Based

- Synthetic Polymer Based

- Albumin & Glutaraldehyde Based

- Wound Closure Strips

By Application

- Cardiovascular

- General

- Gynecological

- Orthopedic

- Ophthalmic

- Others

By Region

- North America

- Europe

- the Asia-Pacific

- Rest of the World

1. Executive Summary

1.1. Market Attractiveness

1.1.1. Global Wound Closure Product Market Share, By Type

1.1.2. Global Wound Closure Product Market Share, By Application

1.1.3. Global Wound Closure Product Market Share, By Region

2. Market Introduction

2.1. Definition

2.2. Scope of the Study

2.3. Key Market Segments

2.3.1. Market Estimate and Forecast by Type

2.3.2. Market Estimate and Forecast by Application

2.3.3. Market Estimate and Forecast by Region

2.4. Study Objectives

2.5. Years Considered

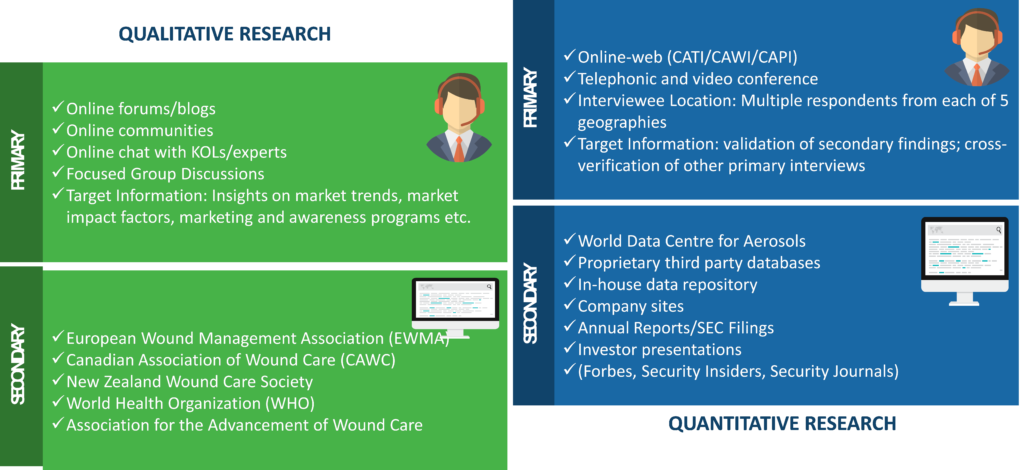

3. Research Methodology

3.1. Qualitative Research

3.2. Methodology

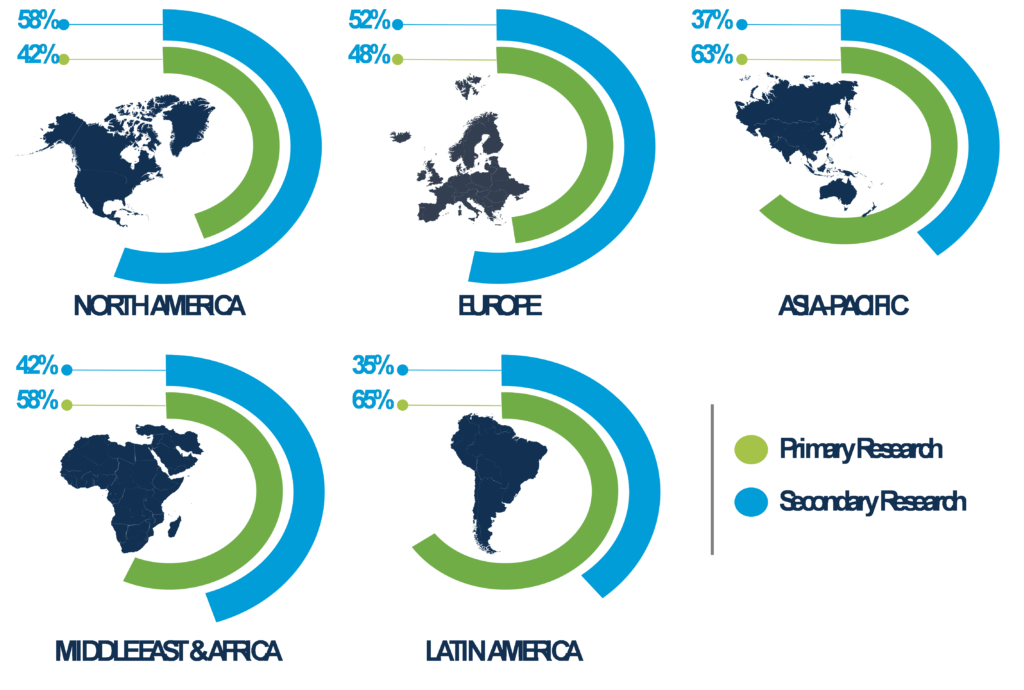

3.3. Regional Split of Primary & Secondary Research

3.4. Secondary Research

3.5. Primary Research

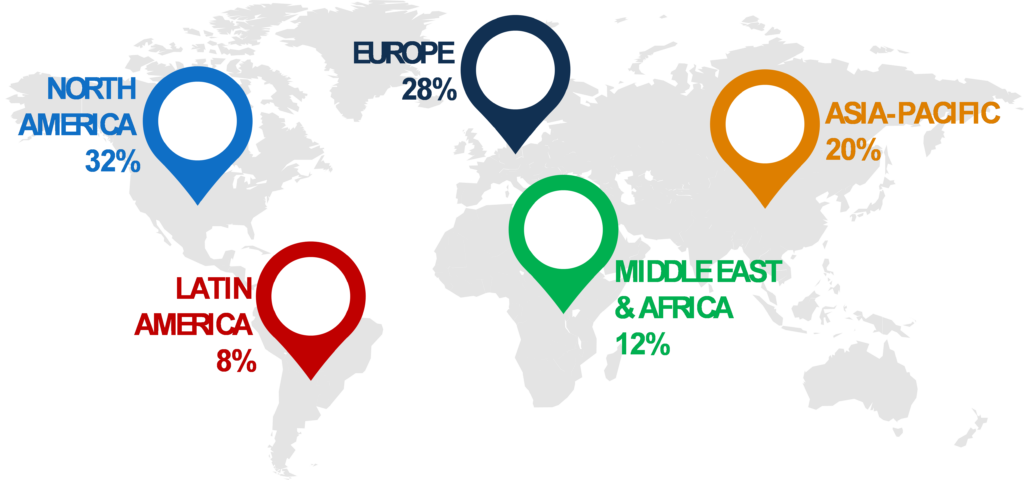

3.5.1. Breakdown of Primary Research Respondents, By Region

3.6. Market Size Estimation

3.7. Assumptions for the Study

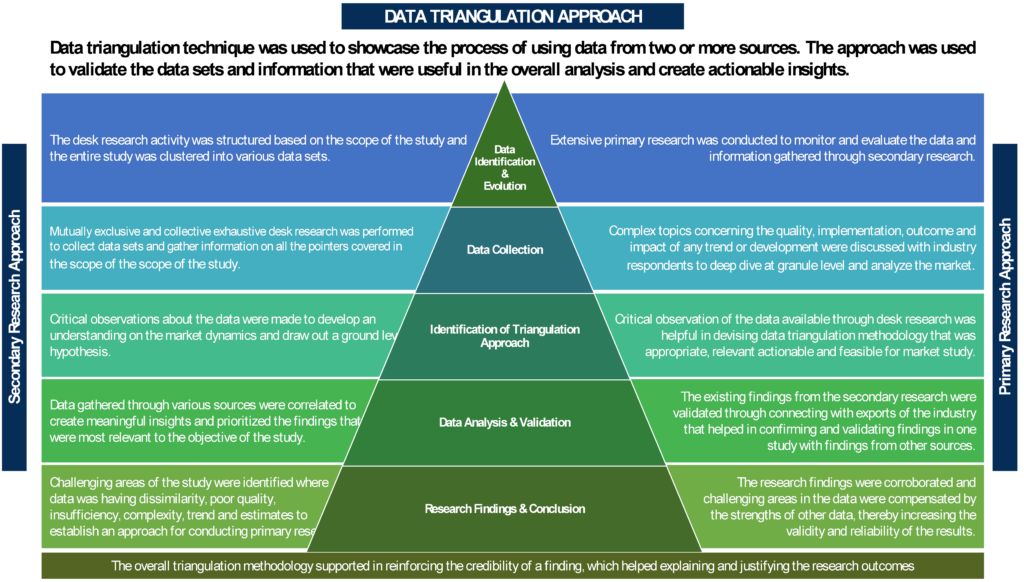

3.8. Market Breakdown & Data Triangulation

4. Market Factor Analysis

4.1. Market Dynamics

4.1.1. Growth Drivers

4.1.1.1. Increasing Number of Road Accidents

4.1.1.2. The Growing Number of Surgeries Performed

4.1.1.3. Emerging Cases of Chronic Wounds

4.1.2. Opportunities

4.1.2.1. Advancements in wound closure products for improving effective

4.1.2.2. Growth of Geriatric population in some of the developed region of the World

4.1.3. Restraints

4.1.3.1. High Costs of Wound Closure Products

4.1.3.2. Less Effectiveness of Some Products

4.2. Porter’s Five Forces Model

4.2.1. Bargaining Power of Suppliers

4.2.2. Bargaining Power of Buyers

4.2.3. Threat of New Entrants

4.2.4. Threat of Substitutes

4.2.5. Competitive Rivalry in The Market

4.3. Impact Analysis of COVID-19

5. Global Wound Closure Product Market

5.1. Introduction

5.2. By Type

5.2.1. Sutures

5.2.1.1. Absorbable Sutures

5.2.1.2. Non-absorbable Sutures

5.2.2. Hemostats

5.2.2.1. Thrombin-based hemostats

5.2.2.2. Oxidized regenerated cellulose-based hemostats

5.2.2.3. Combination hemostats

5.2.2.4. Gelatin-based hemostats

5.2.2.5. Collagen-based hemostats

5.2.3. Surgical Staples

5.2.3.1. Linear Surgical Stapler

5.2.3.2. Circular Surgical Stapler

5.2.3.3. Skin Staple

5.2.4. Adhesives and Tissue Sealants

5.2.4.1. Fibrin sealants

5.2.4.2. Collagen-based sealants

5.2.4.3. Cyanoacrylate-based sealants

5.2.4.4. Synthetic polymer-based sealants

5.2.4.5. Albumin & Glutraldehyde-based sealants

5.2.5. Wound closure product Strips

5.3. By Application

5.3.1. Cardiovascular

5.3.2. General

5.3.3. Gynecological

5.3.4. Orthopaedic

5.3.5. Ophthalmic

5.3.6. Others

5.4. By Region

6. North America Wound Closure Product Market

6.1. Overview

6.2. By Type

6.2.1. Sutures

6.2.2. Hemostats

6.2.3. Surgical Staples

6.2.4. Adhesives and Tissue Sealants

6.3. North America Wound Closure Product Market, By Application, 2017-2027

6.4. North America Wound Closure Product Market, By Country

7. Europe Wound Closure Product Market

7.1. Overview

7.2. By Type

7.2.1. Sutures

7.2.2. Hemostats

7.2.3. Surgical Staples

7.2.4. Adhesives and Tissue Sealants

7.3. Europe Wound Closure Product Market, By Application, 2017-2027

7.4. Europe Wound Closure Product Market, By Country

8. Asia-Pacific Wound Closure Product Market

8.1. Overview

8.2. By Type

8.2.1. Sutures

8.2.2. Hemostats

8.2.3. Surgical Staples

8.2.4. Adhesives and Tissue Sealants

8.3. Asia-Pacific Wound Closure Product Market, By Application, 2017-2027

8.4. Asia-Pacific Wound Closure Product Market, By Country

9. Rest of the World Wound Closure Product Market

9.1. Overview

9.2. By Type

9.2.1. Sutures

9.2.2. Hemostats

9.2.3. Surgical Staples

9.2.4. Adhesives and Tissue Sealants

9.3. Rest of the World Wound Closure Product Market, By Application, 2017-2027

9.4. Rest of the World Wound Closure Product Market, By Country

10. Competitive Landscape

10.1. List of Key Players and Their Offerings

10.2. Major Growth Strategies in the Global Wound Closure Market

10.3. Competitor Benchmarking, By Operating Parameters

10.4. Leading Players in Terms of Number of Developments

10.5. Key Developments & Growth Strategies

10.5.1. New Product Development

10.5.2. Mergers & Acquisitions

10.5.3. Contracts & Agreements

10.5.4. Expansions & Investments

11. Company Profiles

11.1. 3M Company

11.1.1. Company overview

11.1.2. Financial Overview

11.1.3. Products Offered

11.1.5. SWOT analysis

11.1.6. Key Strategies

11.2. Medtronic Plc

11.2.1. Company overview

11.2.2. Financial Overview

11.2.3. Products Offered

11.2.5. SWOT analysis

11.2.6. Key Strategies

11.3. Pfizer Inc.

11.3.1. Company overview

11.3.2. Financial Overview

11.3.3. Products Offered

11.3.5. SWOT analysis

11.3.6. Key Strategies

11.4. Johnson & Johnson

11.4.1. Company overview

11.4.2. Financial Overview

11.4.3. Products Offered

11.4.5. SWOT analysis

11.4.6. Key Strategies

11.5. Smith & Nephew Plc

11.5.1. Company overview

11.5.2. Financial Overview

11.5.3. Products Offered

11.5.5. SWOT analysis

11.5.6. Key Strategies

11.6. Cryolife Inc.

11.6.1. Company overview

11.6.2. Financial Overview

11.6.3. Products Offered

11.6.5. SWOT analysis

11.6.6. Key Strategies

11.7. Integra Lifesciences Corp.

11.7.1. Company overview

11.7.2. Financial Overview

11.7.3. Products Offered

11.7.5. SWOT analysis

11.7.6. Key Strategies

11.8. B. Braun Melsungen AG

11.8.1. Company overview

11.8.2. Financial Overview

11.8.3. Products Offered

11.8.5. SWOT analysis

11.8.6. Key Strategies

11.9. Baxter International Inc.

11.9.1. Company overview

11.9.2. Financial Overview

11.9.3. Products Offered

11.9.5. SWOT analysis

11.9.6. Key Strategies

11.1. DeRoyal Industries, Inc.

11.10.1. Company overview

11.10.2. Products Offered

11.10.4. SWOT analysis

11.10.5. Key Strategies

List of Tables

Table 1: Market Synopsis

Table 2: Assumptions for Market Estimation and Forecast

Table 3: Global Wound Closure ProductHistoricMarket Size, By Type, By Value, USD MILLION (2017-2020)

Table 4: Global Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 5: Global Wound Closure ProductHistoricMarket Size, By Type, For Sutures, By Value, USD MILLION (2017-2020)

Table 6: Global Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 7: Global Wound Closure ProductHistoricMarket Size, By Type, For Hemostat, By Value, USD MILLION (2017-2020)

Table 8: Global Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 9: Global Wound Closure ProductHistoricMarket Size, By Type, For Surgical Staples, By Value, USD MILLION (2017-2020)

Table 10: Global Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 11: Global Wound Closure ProductHistoricMarket Size, By Type, For Adhesives and Tissue Sealants, By Value, USD MILLION (2017-2020)

Table 12: Global Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 13: Global Wound Closure ProductHistoricMarket Size, By Application, By Value, USD MILLION (2017-2020)

Table 14: Global Wound Closure Product Forecast Market Size, By Application, ByValue, USD MILLION (2021-2027)

Table 15: GlobalWound Closure Product MARKET, ByRegion, 2017-2020 (USD MILLION)

Table 16: GlobalWound Closure Product MARKET, ByRegion, 2021-2027 (USD MILLION)

Table 17: North America Wound Closure ProductHistoricMarket Size, By Type, By Value, USD MILLION (2017-2020)

Table 18: North America Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 19: North America Wound Closure ProductHistoricMarket Size, By Type, For Sutures, By Value, USD MILLION (2017-2020)

Table 20: North America Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 21: North America Wound Closure ProductHistoricMarket Size, By Type, For Hemostat, By Value, USD MILLION (2017-2020)

Table 22: North America Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 23: North America Wound Closure ProductHistoricMarket Size, By Type, For Surgical Staples, By Value, USD MILLION (2017-2020)

Table 24: North America Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 25: North America Wound Closure ProductHistoricMarket Size, By Type, For Adhesives and Tissue Sealants, By Value, USD MILLION (2017-2020)

Table 26: North America Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 27: North America Wound Closure ProductHistoricMarket Size, By Application, By Value, USD MILLION (2017-2020)

Table 28: North America Wound Closure Product Forecast Market Size, By Application, ByValue, USD MILLION (2021-2027)

Table 29: North AmericaWound Closure Product MARKET, By Country, 2017-2020 (USD MILLION)

Table 30: North AmericaWound Closure Product MARKET, By Country, 2021-2027 (USD MILLION)

Table 31: Europe Wound Closure ProductHistoricMarket Size, By Type, By Value, USD MILLION (2017-2020)

Table 32: Europe Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 33: Europe Wound Closure ProductHistoricMarket Size, By Type, For Sutures, By Value, USD MILLION (2017-2020)

Table 34: Europe Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 35: Europe Wound Closure ProductHistoricMarket Size, By Type, For Hemostat, By Value, USD MILLION (2017-2020)

Table 36: Europe Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 37: Europe Wound Closure ProductHistoricMarket Size, By Type, For Surgical Staples, By Value, USD MILLION (2017-2020)

Table 38: Europe Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 39: Europe Wound Closure ProductHistoricMarket Size, By Type, For Adhesives and Tissue Sealants, By Value, USD MILLION (2017-2020)

Table 40: Europe Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 41: Europe Wound Closure ProductHistoricMarket Size, By Application, By Value, USD MILLION (2017-2020)

Table 42: Europe Wound Closure Product Forecast Market Size, By Application, ByValue, USD MILLION (2021-2027)

Table 43: EuropeWound Closure Product MARKET, By Country, 2017-2020 (USD MILLION)

Table 44: EuropeWound Closure Product MARKET, By Country, 2021-2027 (USD MILLION)

Table 45: Asia-Pacific Wound Closure ProductHistoricMarket Size, By Type, By Value, USD MILLION (2017-2020)

Table 46: Asia-Pacific Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 47: Asia-Pacific Wound Closure ProductHistoricMarket Size, By Type, For Sutures, By Value, USD MILLION (2017-2020)

Table 48: Asia-Pacific Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 49: Asia-Pacific Wound Closure ProductHistoricMarket Size, By Type, For Hemostat, By Value, USD MILLION (2017-2020)

Table 50: Asia-Pacific Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 51: Asia-Pacific Wound Closure ProductHistoricMarket Size, By Type, For Surgical Staples, By Value, USD MILLION (2017-2020)

Table 52: Asia-Pacific Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 53: Asia-Pacific Wound Closure ProductHistoricMarket Size, By Type, For Adhesives and Tissue Sealants, By Value, USD MILLION (2017-2020)

Table 54: Asia-Pacific Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 55: Asia-Pacific Wound Closure ProductHistoricMarket Size, By Application, By Value, USD MILLION (2017-2020)

Table 56: Asia-Pacific Wound Closure Product Forecast Market Size, By Application, ByValue, USD MILLION (2021-2027)

Table 57: Asia-Pacific Wound Closure Product MARKET, By Country, 2017-2020 (USD MILLION)

Table 58: Asia-PacificWound Closure Product MARKET, By Country, 2021-2027 (USD MILLION)

Table 59: Rest of the World Wound Closure ProductHistoricMarket Size, By Type, By Value, USD MILLION (2017-2020)

Table 60: Rest of the World Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 61: Rest of the World Wound Closure ProductHistoricMarket Size, By Type, For Sutures, By Value, USD MILLION (2017-2020)

Table 62: Rest of the World Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 63: Rest of the World Wound Closure ProductHistoricMarket Size, By Type, For Hemostat, By Value, USD MILLION (2017-2020)

Table 64: Rest of the World Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 65: Rest of the World Wound Closure ProductHistoricMarket Size, By Type, For Surgical Staples, By Value, USD MILLION (2017-2020)

Table 66: Rest of the World Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 67: Rest of the World Wound Closure ProductHistoricMarket Size, By Type, For Adhesives and Tissue Sealants, By Value, USD MILLION (2017-2020)

Table 68: Rest of the World Wound Closure Product Forecast Market Size, By Type, ByValue, USD MILLION (2021-2027)

Table 69: Rest of the World Wound Closure ProductHistoricMarket Size, By Application, By Value, USD MILLION (2017-2020)

Table 70: Rest of the World Wound Closure Product Forecast Market Size, By Application, ByValue, USD MILLION (2021-2027)

Table 71: Rest of the WorldWound Closure Product MARKET, By Country, 2017-2020 (USD MILLION)

Table 72: Rest of the WorldWound Closure Product MARKET, By Country, 2021-2027 (USD MILLION)

Table 73: List of Key players and their Offerings

Table 74: Major Growth Strategies in the Global wound closure Market

Table 75: Competitor benchmarking, by operating parameters

Table 76: Leading Players in Terms of Development

Table 77: New Product development

Table 78: Mergers&Acquisitions

Table 79: Contracts&Agreements

Table 80: Expansions &Investments

Table 81: 3M Company: Financial Overview Snapshot

Table 82: 3M Company: Products Offered

Table 83: 3M Company: Key Developments

Table 84: Medtronic PLC: Financial Overview Snapshot

Table 85: Medtronic PLC: Products Offered

Table 86: Medtronic PLC: Key Developments

Table 87: Pfizer Inc.: Financial Overview Snapshot

Table 88: Pfizer Inc.: Products Offered

Table 89: Pfizer inc.: Key Developments

Table 90: Johnson & Johnson: Financial Overview Snapshot

Table 91: Johnson & Johnson: Products Offered

Table 92: Johnson & Johnson: Key Developments

Table 93: Smith & Nephew Plc: Financial Overview Snapshot

Table 94: Smith & Nephew Plc: Products Offered

Table 95: SMITH & NEPHEW PLC: Key Developments

Table 96: Cryolife Inc.: Financial Overview Snapshot

Table 97: Cryolife Inc.: Products Offered

Table 98: Cryolife Inc.: Key Developments

Table 99: Integra Lifesciences: Financial Overview Snapshot

Table 100: Integra Lifesciences: Products Offered

Table 101: Integra Lifesciences: Key Developments

Table 102: B. Braun Melsungen AG: Financial Overview Snapshot

Table 103: B. Braun Melsungen AG: Products Offered

Table 104: B. Braun Melsungen AG: Key Developments

Table 105: Baxter International Inc.: Financial Overview Snapshot

Table 106: Baxter International Inc.: Products Offered

Table 107: Baxter International Inc.: Key Developments

Table 108: DeRoyal Industries, Inc.: Products Offered

Table 109: DeRoyal Industries, Inc.: Key Developments

List of Figures

Figure 1: Global Wound Closure Product Market Size, By Value, USD Million

Figure 2: Global Wound Closure Product Market share 2020, By Type

Figure 3: Global Wound Closure Product Market share 2020, By Application

Figure 4: Global Wound Closure Product Market share, By Region

Figure 5: Market Segments

Figure 6: Research Phases

Figure 7: Methodology

Figure 8: Regional Split of Primary & Secondary Research

Figure 9: Secondary Sources for different Parameter

Figure 10: Breakdown of Primary Research Respondents, By Region

Figure 11: Traffic fatalities recorded as per National Highway Traffic Safety Administration, 2015-2020

Figure 12: Global Wound Closure Product Market Size & Forecast (2017 – 2027)

Figure 13: Global Wound Closure Product Market Share & Forecast, By Type (2017 – 2027)

Figure 14: Global Wound Closure Product Market Share & Forecast, By Type, For Sutures (2017 – 2027)

Figure 15: Global Wound Closure Product Market Share & Forecast, By Type, For Hemostat (2017 – 2027)

Figure 16: Global Wound Closure Product Market Share & Forecast, By Type, For Surgical Staples (2017 – 2027)

Figure 17: Global Wound Closure Product Market Share & Forecast, By Type, For Adhesives and Tissue Sealants (2017 – 2027)

Figure 18: Global Wound Closure Product Market Share & Forecast, By Application (2017 – 2027)

Figure 19: Global Wound Closure Product Market, BY Region, 2020 VS 2027 (USD MILLION)

Figure 20: North America Wound Closure Product Market Size & Forecast (2017 – 2027)

Figure 21: North America Wound Closure Product Market Share & Forecast, By Type (2017 – 2027)

Figure 22: North America Wound Closure Product Market Share & Forecast, By Type, For Sutures (2017 – 2027)

Figure 23: North America Wound Closure Product Market Share & Forecast, By Type, For Hemostat (2017 – 2027)

Figure 24: North America Wound Closure Product Market Share & Forecast, By Type, For Surgical Staples (2017 – 2027)

Figure 25: North America Wound Closure Product Market Share & Forecast, By Type, For Adhesives and Tissue Sealants (2017 – 2027)

Figure 26: North America Wound Closure Product Market Share & Forecast, By Application (2017 – 2027)

Figure 27: North AmericaWound Closure Product Market Share, BY Country, 2017-2027

Figure 28: Europe Wound Closure Product Market Size & Forecast (2017 – 2027)

Figure 29: Europe Wound Closure Product Market Share & Forecast, By Type (2017 – 2027)

Figure 30: Europe Wound Closure Product Market Share & Forecast, By Type, For Sutures (2017 – 2027)

Figure 31: Europe Wound Closure Product Market Share & Forecast, By Type, For Hemostat (2017 – 2027)

Figure 32: Europe Wound Closure Product Market Share & Forecast, By Type, For Surgical Staples (2017 – 2027)

Figure 33: Europe Wound Closure Product Market Share & Forecast, By Type, For Adhesives and Tissue Sealants (2017 – 2027)

Figure 34: Europe Wound Closure Product Market Share & Forecast, By Application (2017 – 2027)

Figure 35: Europe WOUND CLOSURE PRODUCT MARKET Share, BY Country, 2017-2027

Figure 36: Asia-Pacific Wound Closure Product Market Size & Forecast (2017 – 2027)

Figure 37: Asia-Pacific Wound Closure Product Market Share & Forecast, By Type (2017 – 2027)

Figure 38: Asia-Pacific Wound Closure Product Market Share & Forecast, By Type, For Sutures (2017 – 2027)

Figure 39: Asia-Pacific Wound Closure Product Market Share & Forecast, By Type, For Hemostat (2017 – 2027)

Figure 40: Asia-Pacific Wound Closure Product Market Share & Forecast, By Type, For Surgical Staples (2017 – 2027)

Figure 41: Asia-Pacific Wound Closure Product Market Share & Forecast, By Type, For Adhesives and Tissue Sealants (2017 – 2027)

Figure 42: Asia-Pacific Wound Closure Product Market Share & Forecast, By Application (2017 – 2027)

Figure 43: Asia-PacificWound Closure Product Market Share, BY Country, 2017-2027

Figure 44: Rest of the World Wound Closure Product Market Size & Forecast (2017 – 2027)

Figure 45: Rest of the World Wound Closure Product Market Share & Forecast, By Type (2017 – 2027)

Figure 46: Rest of the World Wound Closure Product Market Share & Forecast, By Type, For Sutures (2017 – 2027)

Figure 47: Rest of the World Wound Closure Product Market Share & Forecast, By Type, For Hemostat (2017 – 2027)

Figure 48: Rest of the World Wound Closure Product Market Share & Forecast, By Type, For Surgical Staples (2017 – 2027)

Figure 49: Rest of the World Wound Closure Product Market Share & Forecast, By Type, For Adhesives and Tissue Sealants (2017 – 2027)

Figure 50: Rest of the World Wound Closure Product Market Share & Forecast, By Application (2017 – 2027)

Figure 51: Rest of the World Wound Closure Product Market Share, By Country, 2017-2027

Figure 52: 3M Company: Business revenue 2020

Figure 53: 3M Company: Regional revenue 2020

Figure 54: 3M Company: SWOT Analysis

Figure 55: Medtronic PLC: Business revenue 2020

Figure 56: Medtronic PLC: Regional revenue 2020

Figure 57: Medtronic PLC: SWOT Analysis

Figure 58: Pfizer Inc.: Business revenue 2020

Figure 59: Pfizer Inc.: Regional revenue 2020

Figure 60: Pfizer inc.: SWOT Analysis

Figure 61: Johnson & Johnson: Business revenue 2020

Figure 62: Johnson & Johnson: Regional revenue 2020

Figure 63: Johnson & Johnson: SWOT Analysis

Figure 64: Smith & Nephew Plc: Business revenue 2020

Figure 65: Smith & Nephew Plc: Regional revenue 2020

Figure 66: SMITH & NEPHEW PLC: SWOT Analysis

Figure 67: Cryolife Inc.: Business revenue 2020

Figure 68: Cryolife Inc.: Regional revenue 2020

Figure 69: Cryolife Inc.: SWOT Analysis

Figure 70: Integra Lifesciences: Business revenue 2020

Figure 71: Integra Lifesciences: Regional revenue 2020

Figure 72: Integra Lifesciences: SWOT Analysis

Figure 73: B. Braun Melsungen AG: Business revenue 2020

Figure 74: B. Braun Melsungen AG: Regional revenue 2020

Figure 75: B. Braun Melsungen AG: SWOT Analysis

Figure 76: BAXTER INTERNATIONAL INC.: Business revenue 2020

Figure 77: Baxter International Inc.: Regional revenue 2020

Figure 78: Baxter International Inc.: SWOT Analysis

Figure 79: DeRoyal Industries, Inc.: SWOT Analysis

Market Segmentation

By Type

- Sutures

- Absorbable Sutures

- Non- Absorbable Sutures

- Hemostats

- Thrombin Based

- Oxidized Regenerated Cellulose Based

- Combination Hemostats

- Gelatin Based Hemostats

- Collagen Based Hemostats

- Surgical Staples

- Linear Surgical Stapler

- Circular Surgical Stapler

- Skin Stapler

- Others

- Adhesives and Tissue Sealants

- Fibrin

- Collagen Based

- Cyanoacrylate Based

- Synthetic Polymer Based

- Albumin & Glutaraldehyde Based

- Wound Closure Strips

By Application

- Cardiovascular

- General

- Gynecological

- Orthopedic

- Ophthalmic

- Others

By Region

- North America

- Europe

- the Asia-Pacific

- Rest of the World

1. Research Methodology

2. Regional Split of Primary & Secondary Research

3. Secondary Research

The research process began with obtaining historical market sizes of the entire wound closure market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the wound closure market and its expected long-term impact. Weightage was given to several forces that are expected to affect the home security market, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

4. Primary Research

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the global wound closure market were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes

4.1 Breakdown of Primary Research Respondents, By Region

4.2 Breakdown of Primary Research Respondents, By Industry Participants

5. Market Size Estimation

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by type and by application.

An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

6. Assumptions for the Study

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

7. Market Breakdown & Data Triangulation

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

Frequently Asked Questions (FAQs):

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research Support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Custom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.